What Falling Treasury Yields Could Mean for You—and Your Real Estate Plans

By Mark Pinilla

You may have seen some headlines lately about the 10-year Treasury yield dropping below 4%. That probably sounds like something out of an economics textbook—but here’s why it actually matters to you, especially if you’re thinking about buying, refinancing, or investing in real estate.

When the 10-year Treasury yield drops, mortgage rates often follow. So this recent dip could be a sign that lower mortgage rates are on the way. And that’s great news for buyers, homeowners, and investors who are looking to make smarter moves while the opportunity is here.

What This Means for Buyers and Homeowners

If you’re a buyer, lower interest rates could make homes a little more affordable again—monthly payments go down when rates drop. And if you’re a homeowner with a rate that’s higher than today’s, this might be the right time to consider refinancing to lower your payment or free up some equity.

Even a small change in interest rates can make a noticeable difference in your monthly budget, so it’s worth paying attention.

Why Real Estate Still Makes Sense

The stock market has been up and down lately, and a lot of people are feeling uncertain about where to put their money. That’s one reason real estate continues to stand out—it’s a tangible, long-term investment that people trust.

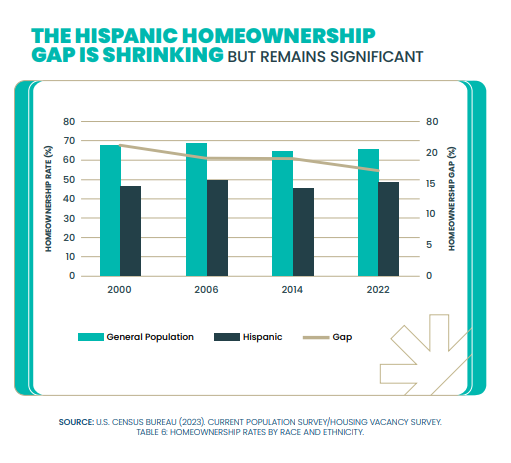

When things feel unstable, people tend to look for something solid. Real estate has always been that kind of anchor—especially when it comes to building generational wealth or just creating more security for your family.

According to CNBC, the recent drop in yields is linked to economic concerns and shifts in investor confidence—further fueling demand for more stable investments like housing.

Let’s Talk Strategy—Without the Stress

You don’t need to be a financial expert to make smart real estate decisions. That’s what I’m here for.

My job is to keep an eye on what’s happening in the market and help you figure out how it applies to your situation. Whether you’re just starting to explore your options or already thinking about your next move, I’ll help you:

- Understand what this interest rate shift could mean for your plans

- Explore refinancing or buying opportunities with less pressure

- Make informed, confident decisions—at your pace

A Good Time to Check In

No one knows exactly what the market will do next—but when rates show signs of dropping, it’s usually a good time to pause, reassess, and consider your options.

If you’ve been thinking about buying, selling, or refinancing, let’s connect. I’ll walk you through what’s happening without overwhelming you—and we’ll see if now’s the right time to take action or simply prepare for what’s next.

Mark Pinilla

Helping you navigate real estate with clarity and confidence.

#RealEstateNews #MortgageRates #RefinanceTips #HomeBuyingTips #RealEstateMarket #HomeLoans #RealEstateInvesting #HousingMarket2025 #MarkPinilla