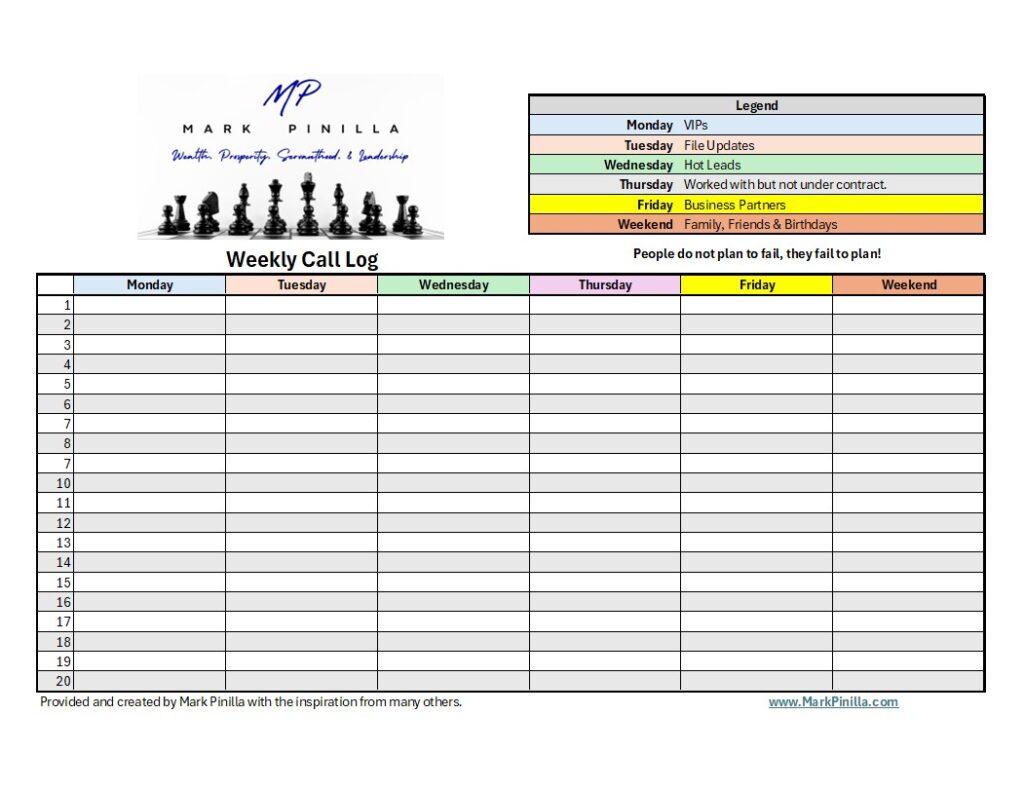

Success in business and life doesn’t happen by chance—it happens by planning. As Rick Guerrero, a NAHREP 10 Certified Trainer, emphasizes, preparation is everything. He starts each week by creating a call log every Sunday, setting the foundation for intentional and productive interactions. His approach mirrors NAHREP Discipline #2: Be in the top 10% of your profession by taking your craft seriously and working toward mastery. Learn more about the NAHREP 10 Disciplines here.

Sara Mendez Rodriguez, CEO of Titan Title & Chairperson for the Hispanic Wealth Project, suggests a themed call log to ensure balance and variety. For example:

- Monday: VIPs

- Wednesday: Focus on hot leads.

- Friday: Reach out to business partners.

- Weekend: Dedicate time to friends, family, and birthday celebrations.

Why Following Up Matters

According to statistics, 70% of buyers and sellers choose a real estate agent based on referrals from friends and family. This underscores the importance of maintaining personal and professional connections. Planning calls with intention, as suggested by Rick and Sara, ensures you never miss an opportunity to nurture these relationships.

Real Estate Insights for Relationships

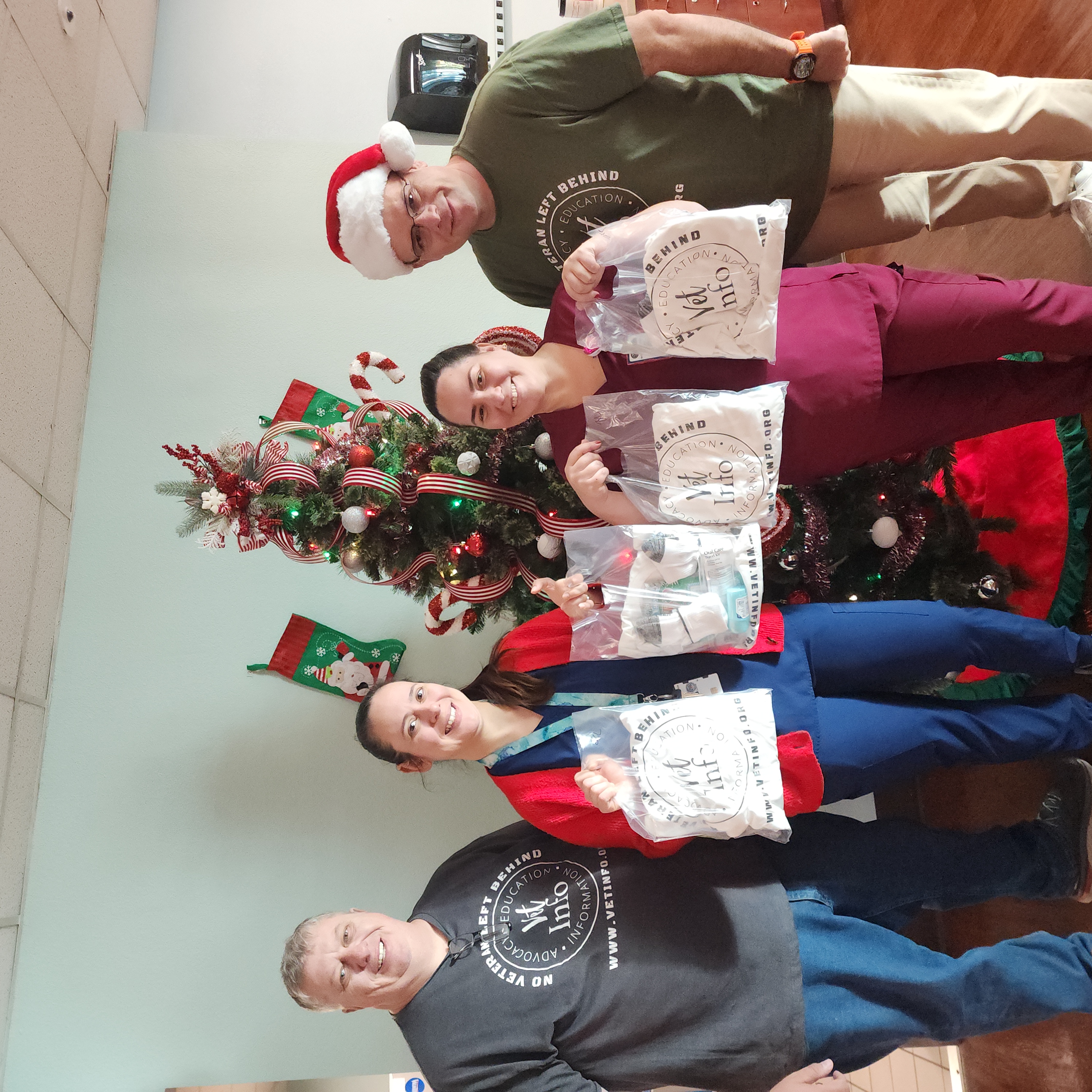

To add his personal touch to the call log, Mark Pinilla, a NAHREP 10 Certified Trainer, added the weekend column. Birthdays and family milestones aren’t just personal—they can be professional goldmines. Studies show that buyers and sellers often prefer working with someone they know and trust. By incorporating these touchpoints into your weekend calls, you position yourself as their go-to expert when the time comes.

Action Plan with Mark Pinilla

For those looking to maximize their wealth-building strategy, contact Mark Pinilla, a trusted resource for investment properties and real estate expertise. Waiting is not in your best interest—contact Mark here.